Buying wine at Sylvie's in a nutshell

Home of wine aficionados

Nowhere else at auction you will find this level of thoroughly examined wines in such a wide and diverse range. This is what makes Sylvie's unique.

Participate in the auction

You can participate effortless in the following ways :

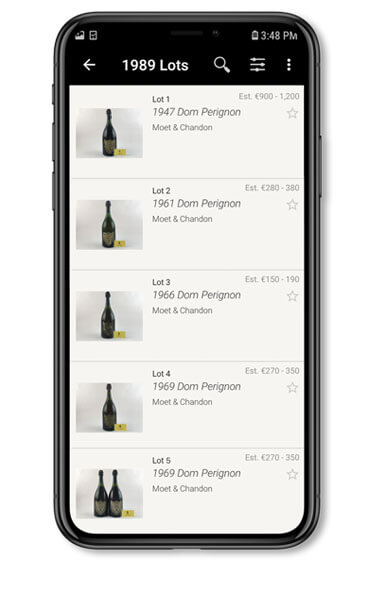

- live online via your smartphone or tablet via the Sylvie's App on the Auction Mobility platform ;

- by placing a maximum bid by logging in to this website via the 'login/register' button at the top right of your screen ;

- in the auction room ;

- by telephone on 0032 (3)7769077 ;

- by e-mail ;

- by a written mandate on site. Sylvie's will place your bids on your behalf in the auction room.

All options can be used during the same auction. You need to register separately for each online platform. We advise you to choose one way per lot to avoid bidding against yourself.

The fees for participation are the same for all options mentioned. This allows you to freely choose your preferred way of bidding. There is a rescue service to help you place your bids during the auction, when all other options are no longer available. Just mail or call us and we see how we can assist you.

You can follow the auctions live online via your smartphone, tablet or PC. No registration is required to follow the auction from your screen.

Payment, collection and shipping

Payment for your purchases should be made within 7 days of receiving your purchase list. Upon request, we offer free storage for 6 months, subject to timely payment. This storage is temperature-controlled, well-secured and all-risk insured.

If you are unable to collect your wines yourself, in many cases we can organize shipping for you. You will find the rates and conditions for shipping parcels to many countries within and outside the European Union in the buyers' guide.

We charge you the shipping charges that carriers charge us. Purchases worth more than €5,000.00 per auction having a final destination in Belgium and the Netherlands, are delivered free of charge via an all-risk insured transport. This free service does not apply to the shipment of VAT lots to the Netherlands.

Buyers' commission

The buyer's commission is 19% in 2024. This is exclusiev of the VAT applicable in the destined country. You can find the VAT rates of the countries in the European Union in the buyers' guide.

Single point of contact

Do you have any questions? We will be happy to assist you personally. You can contact us on working days and between 9:00 and 17:00 CET at 0032 (3)7769077. You can also email us at info@sylvies.be.

We recommend asking your questions prior to an auction.

Last modified 25th of May 2024

-

Why buy wine at Sylvie’s?

Sylvie's is home for everyone with a passion for wine

The soul of Sylvie’s lies in the genuine passion for wine. As a team we share our enthusiasm with you through the auction. We offer a high level of quality in a broad range and an extensive diversity regarding countries, wine regions, formats and vintages.

Legitimate wine authentication knowledge can only derive from obsession and experience. Since 1987 Sylvie’s has been a reliable authority in our field and you benefit from this when selecting your wines.